2 for the Act wef. Since introduction of GST the Central Government has notified a number of goods and services us 93 of CGST Act for the purpose of levy of GST under reverse charge mechanism.

SUBTITLE IHARMONIZED TARIFF SCHEDULE OF THE UNITED STATES Editorial Notes Codification.

. List of Amending Acts 1. The Repealing and Amending Act 1960 58 of 1960. Procedure for sale of goods and application of sale proceeds.

Negotiable paper given as price of liquor illegally sold if transferred after due is void. Government Publishing Office Page 2533 FURTHER CONSOLIDATED APPROPRIATIONS ACT 2020 Page 133 STAT. Rules Income Tax Rules.

It came on the Statute Book as THE MUNICIPAL CORPORATION ACT 1957 66 of 1957. LIQUOR CONTROL ACT The following cases decided prior to enactment of the Liquor Control Act of 1933. Budget and Bills Finance Acts.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Approved website under the Legislation Act 2001 ACT. Containing public news or observations thereon or consisting wholly or mainly of advertisements which is printed for sale and is published in Singapore either periodically or in parts or numbers at intervals not exceeding 36 days.

116th Congress Public Law 94 From the US. Alcohol would be an appropriate complement to goods of the kind sold or to be sold in the shop. Direct Taxes Code 2010 Bill No.

87456 title I 101a May. Plaintiffs liquors kept for illegal sale were attached and removed as goods of another party. In this article we are discussing such goods and services which have been notified by the Central Government for the purposes of RCM.

New Zealands Sale of Goods Act was passed in 1908 by the Liberal Government of New Zealand. By Act 68 of 1957 s. Liability of officers and certain other persons.

Nothing in this Act applies to the sale or supply of alcohol by a person in the course of the persons business as a maker importer distributor or wholesaler of alcohol to. 2 Subsection 1 overrides section 321 but is overridden. 2534 Public Law 116-94 116th Congress An Act Making further consolidated appropriations for the fiscal year ending September 30 2020 and for other purposes.

Act 66 of 1957 The Delhi Municipal Corporation Bill having been passed by both the Houses of the Parliament was assented by the President on 28th December 1957. Central GST Act 2017 CGST Central GST Rules 2017 CGST Settlement of funds Rules 2017. Application of certain provisions of this Act to coastal goods etc.

830 relating to precursor and essential. Last updated at 10 September 2022 001504 AEST Back to top. Directly or indirectly results in bid rigging or collusive bidding shall be presumed to have an appreciable adverse effect on competition.

3 for any industrial establishment or in any class or group of industrial establishments. 110 of 2010 Direct Taxes Code 2013. Central GST CGST.

Confiscation or penalty not to interfere with other punishments. Limitation of redemption actions land. Other Direct Tax Rules.

Extinction of title of mortgagee to mortgaged land after expiration of period for action claiming sale of land. Or motor transport service engaged in carrying passenger or goods or both by road for hire or reward. Detention seizure and release of goods and conveyances in transit.

Provided that nothing contained in this sub-section shall apply to any agreement entered into by way of joint ventures if such agreement increases efficiency in production supply distribution storage acquisition or control of goods or. 100690 6466 inserted section 542 relating to entry of goods by means of false statements section 549 relating to removing goods from Customs custody and section 2319 relating to copyright infringement section 310 of the Controlled Substances Act 21 USC. Case Laws - All States.

PART I General Provisions 1 Short title and interpretation 1 This Act may be cited as. Limitation of actions by incumbrancers claiming sale of land. 2 In this Act and except in so far as the context otherwise requires in any other Act including any Act of the Parliament of Northern Ireland the Communities means the European Economic Community the European Coal and Steel.

The GST standard rate has been revised to 0 beginning 1 June 2018 pending. 590 672 which comprised the dutiable and free lists for articles imported into the United States were formerly classified to sections 1001 and 1201 of this title and were stricken by Pub. Titles I and II of act June 17 1930 ch.

Slander of goods and other malicious falsehood as they apply to actions for. List of Goods under RCM in GST. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

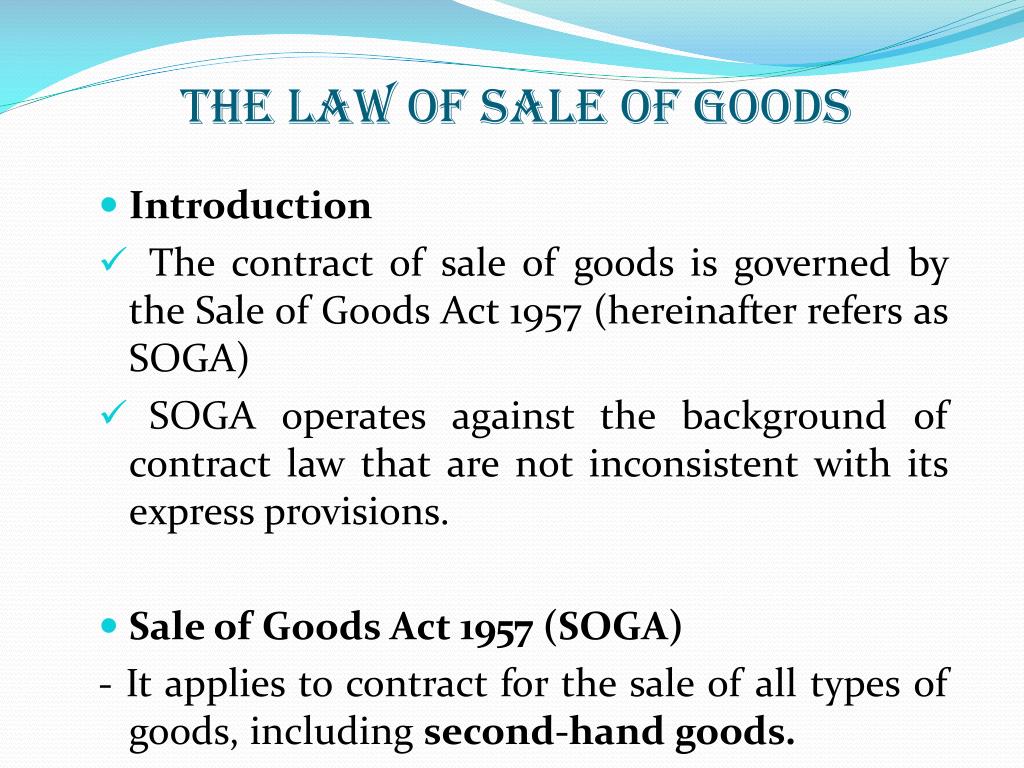

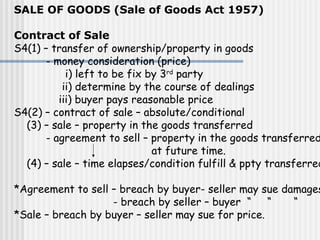

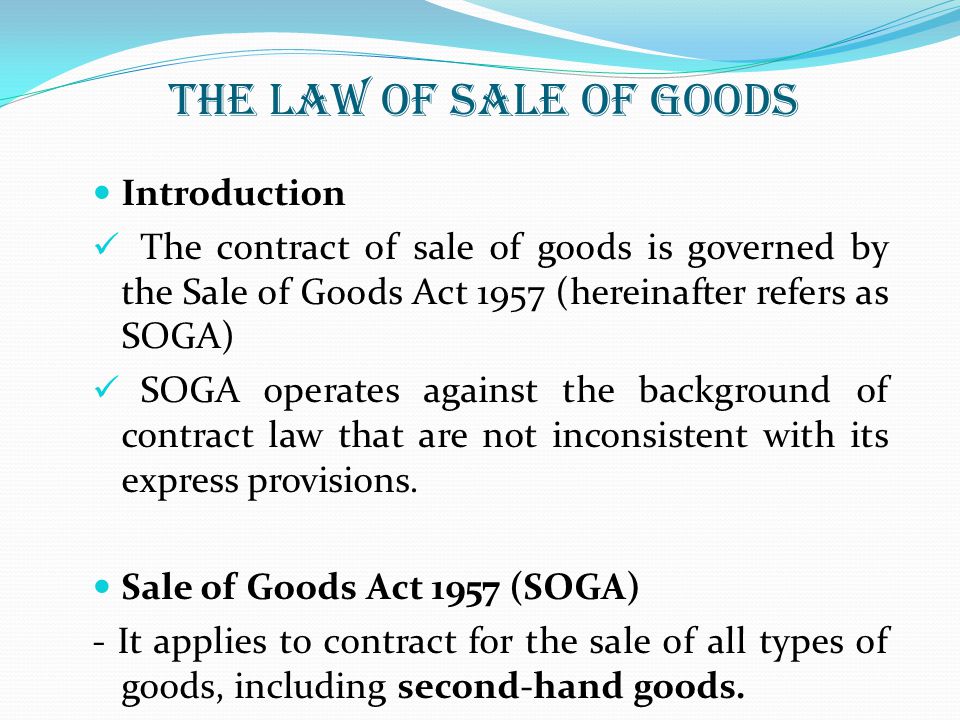

Sign up to our newsletter to hear about future sales and keep up to date with the latest news. The Sale of Goods Act 1957 applies. The European Communities Act 1972.

The Jimmy Choo Sale has now ended. Punishment for certain offences. Confiscation of goods or conveyances and levy of penalty.

For example section 16 of the UKs Sale of Goods Act 1979 and section 18 of the Sale of Goods Act 1930 Bangladesh state that where there is a contract for the sale of unascertained goods no. By Act 38 of 1982 s. Extinction of title of mortgagor to mortgaged land after expiration of period for action to redeem land.

Ppt Sale Of Goods Powerpoint Presentation Free Download Id 5368573

Sale Of Goods Act 1957 Act 382 Marsden Professional Law Book

0 Comments